- Home

- Digital Banking

Banking from anywhere, at anytime, on any device.

Let your customers bank when, how and where they choose. Cloud-enabled, fully scalable and agnostic to a bank’s core systems for easy integration, elevate and differentiate your digital banking platform in both experience and performance.

Our expertise

Banks must meet the needs of digitally demanding self-supervising and always-on-the-move customers

In today’s fast-paced world, people want a seamless, simple and convenient banking experience. They're after not only superior products and services but also personalised and responsive interactions that align with their unique financial requirements.

Having a comprehensive Digital Banking solution can give you that advantage by keeping you relevant, competitive and at the forefront of the industry.

Discover how Sandstone’s digital banking solution can work for you and your customers.

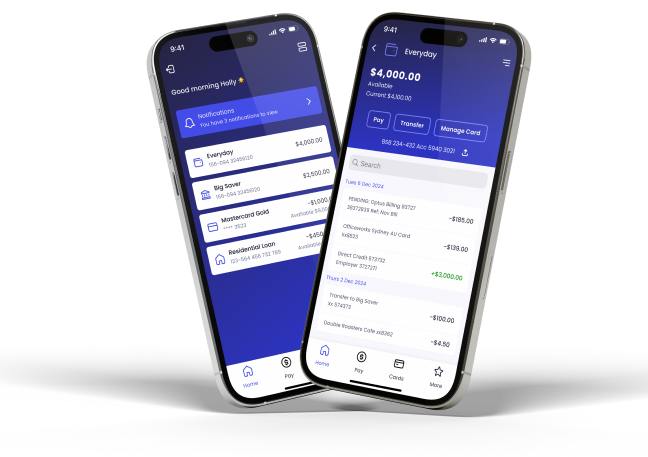

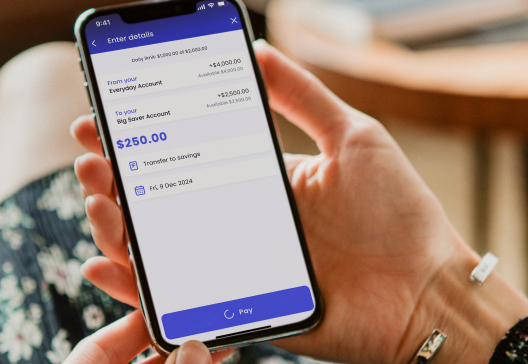

Effortless banking at your customers’ fingertips

Discover the benefits of our cloud enabled Digital Banking solution developed to enhance the service you offer customers across all channels, 24/7.

- Seamless and intuitive banking experience across mobile and web to improve the entire customer journey

- Scalable, and agnostic digital solution for seamless integration to your systems

- Catering for self service and assisted channel capabilities

- Secure with the latest multi-factor authentication technology and fraud monitoring integration

- Boost digital adoption within your customer base and reduce cost to serve

- And so much more

Our impact on the financial landscape

Great Southern Bank, Australia

40% of loan applications approved in less than two days

Great Southern Bank together with Sandstone Technology re-imagine the home lending experience to deliver a robust out-of-the-box lending origination platform.

Discover how Sandstone's loan origination enabled the bank to reduce operational, compliance, credit risk, and automate manual tasks to allow the bank to focus on other important things such as the customer experience.

Frequently Asked Questions

What is a Digital Banking platform?

A Digital Banking platform enables a financial institution's customers to access and service their accounts online.

How secure is Digital Banking?

Digital Banking providers use advanced security measures to protect user data and transactions including multi-factor authentication, continuous monitoring, encryption and other fraud prevention measures.

What are the benefits of Digital Banking?

Digital Banking offers safe and secure 24/7 access to banking services. It is convenient, fast and can offer a personalised experience.

What makes Sandstone’s Digital Banking platform different from other providers?

Our omni-channel banking solution is rich in functionality, security, and performance. It goes beyond a simple online experience, ensuring a seamless and consistent service whether your customers prefer self-service or assisted banking.

Is Sandstone’s Digital Banking solution cloud-based or on-premise?

Our platform can be deployed both on cloud or on-premise based on your institution's needs.

How easily can Sandstone’s Digital Banking platform integrate with our existing core banking system?

With 25+ years of proven track record across the globe, we ensure seamless integration with leading core banking systems and third party integrations with open APIs.

Does Sandstone support digital onboarding for new customers?

Yes, we offer frictionless end-to-end onboarding and digital lead capture solution. Find out more about our Digital Origination solution.

Is Digital Banking the same as Online Banking?

Online Banking allows customers to fulfil their core banking needs online, whereas Digital Banking generally comes with a wider suite of tools and services including Mobile Banking.

What is digital transformation in banking?

When banks fundamentally use digital technologies to transform the way they operate with the aim to improve efficiencies, customer experience and adapt to the changing market dynamics.

What are the benefits of cloud-based solutions/banking?

It is efficient, scalable, secure - delivering trust in financial services. It can also help and security compliance requirements.

Request a demo and see how our Digital Banking solutions solve everyday problems!