- Home

- Case Studies

- Shawbrook Bank

Shawbrook Bank deploys digital origination and online banking platforms.

The challenge: Deliver best-in-class CX

Shawbrook Bank is a flagship challenger bank, highly awarded for its customer-centric products. Shawbrook selected Sandstone Technology to deliver its online origination platform as well its online banking system.

Shawbrook sources its deposits online, with the majority through its online platform, enabling the bank to raise significant volumes of retail and SME deposits based on fair and consistent pricing. This direct sourcing model enables Shawbrook to be flexible in its approach to funding, including managing in flows and tailoring maturity of the deposits to manage liquidity risk. This online channel is supported by a highly experienced Retail Savings team, providing support to new and existing customers.

Our solution

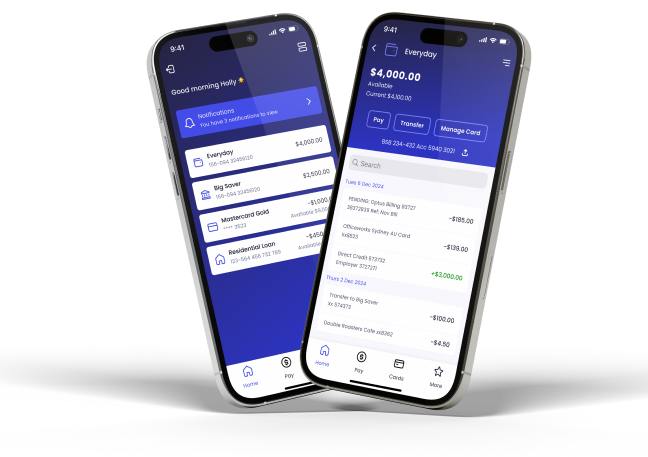

BankFast Online

Shawbrook Bank, a challenger bank renowned for its simplicity and exceptional customer experience (CX), has strengthened its market position through the successful implementation of Apply and BankFast Online Banking.

These new platforms were delivered into production in an impressive six months, resulting in a significant boost to the bank's deposit base. In just the first year, deposits grew by a substantial 65%, and over two years, the bank welcomed 63,000+ new accounts.

The technological backbone behind Shawbrook's growth is provided by Sandstone Technology's world-class solutions. Sandstone Apply eSavings Self Service Customer On-boarding and Product Origination, and BankFast Online Banking, empower Shawbrook to offer a seamless customer experience.

The new platform supports essential features like ISA transfer management and eStatements, while also enabling the bank to rapidly launch new tranches and products. This agility is a key differentiator for Shawbrook, consistently placing them at the top of best buys tables.

Our impact

k+

new account growth in under two years

%

In 2014 deposits grew by 65% to £2.5bn in deposits

Download the full Shawbrook Bank Case Study