- Home

- Case Studies

- P&N Bank

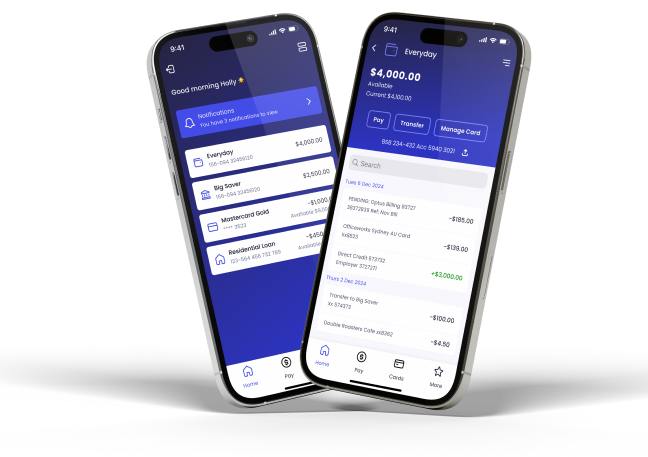

P&N Bank transforms its end-to-end lending experience.

P&N Bank partnered with Sandstone Technology to help deliver a key initiative that forms part of its digital transformation strategy and improves the competitiveness of its digital lending proposition.

By harnessing feedback from their customers and examining the performance of its processes, P&N Bank identified some significant opportunities to transform its customer experience by embracing digital technologies and ways of working.

The challenge: Removing the friction from the customer experience

The bank embarked on a major service re-design of its digital personal loan and credit card application user journeys, with the aim of removing points of friction, improving applicant visibility and transparency and, most importantly, reducing application wait times through improved process efficiency.

In collaboration with the team at Sandstone Technology, P&N Bank identified, scoped, estimated and planned the delivery of over 25 major features to its digital lending origination platform, powered by Sandstone Apply's Application Tracker and LendFast Origination applications.

Our solution

Upgraded loan application system

These enhancements culminated in an upgraded loan application system for P&N Bank’s customers, which aimed to make the online lending application experience easier to navigate through:

User interface enhancements, including providing more contextual information, help and tips.

Improvements to application data capture to ensure that all information required to complete an assessment is provided upfront by the customer and, importantly, mapped to LendFast Origination to use in application processing, streamlining end-to-end processing, removing touch points and reducing rework.

New error proofing measures via system validation to ensure data accuracy and completeness.

Product selection support within the application to ensure appropriate product selection based on the needs and objectives of the applicant.

The ability for applicants to seamlessly switch channels mid-application.

Digitising the customer application and onboarding process, including applying for a P&N Bank membership, internet banking and e-statements registration.

Simplifying supporting information requirements.

Leveraging the benefits of electronic identification.

Keeping applicants informed of their applications progress using Sandstone’s Application Tracker system.

A new form editor capability, leveraging Sandstone Apply’s Bank in Control feature, allowing P&N Bank to update application form labels and content easily and quickly, so we can be responsive to future customer feedback.

Our impact

%

reduction in the time taken to fund a new credit card

%

reduction in applicant effort when applying online

+

fold increase in usage of the digital application tracker

Download the full P&N Bank Case Study