- Home

- Case Studies

- Great Southern Bank

Great Southern Bank navigates the lending landscape.

For over 75 years, Great Southern Bank has been putting their customers first, and today they look after the financial needs of more than 400,000 Australians. They have changed their name from CUA to Great Southern Bank, but they remain customer-owned and firmly focused on their purpose of helping all Australians own their own homes.

The challenge: Optimising loan origination systems

Navigating the highly competitive and rapidly evolving home loan market is a constant for financial institutions. Customer-owned bank Great Southern Bank’s purpose is to help all Australians own their own home. However, they face several challenges.

Intense competition in the broker space

The financial services industry, especially the mortgage sector, is highly competitive. The broker channel in Australia accounts for more than 74% of home loans processed, creating the need for Great Southern Bank to differentiate itself through superior service, innovative products, and competitive rates to attract and retain customers, particularly via the broker channel.

Supporting first-time home buyers

The bank wanted to help simplify the home buying process and provide tailored financial solutions to support its purpose and enable more Australians to realise their dream of home ownership.

Enhancing investment loans to expand market share

In addition to supporting first-time home buyers in a highly competitive environment, the bank also recognised investment loans as a strategic opportunity to diversify its portfolio and reach more customers.

Addressing the challenges

With a lending transformation program already in flight, the bank and Sandstone Technology worked together to focus on how an already established, robust loan origination solution could further enhance operational efficiency, improve customer experiences and support the bank’s delivery of its purpose.

Our solution

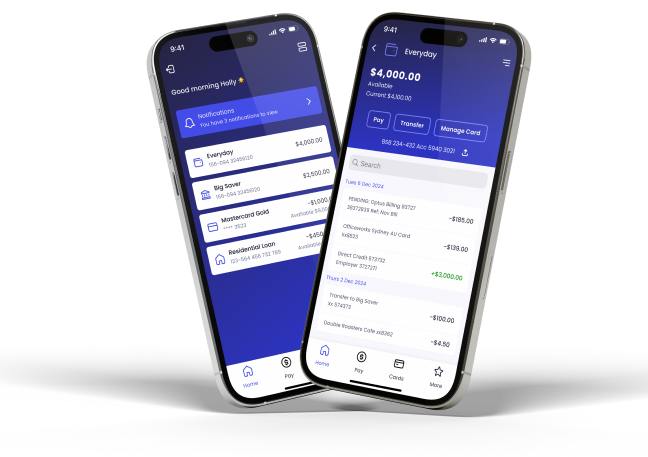

Automated loan origination with LendFast

Sandstone’s loan origination platform, LendFast, streamlined the loan process, making it digital, easy, and customer-focused. It enabled Great Southern Bank to automate key processes, reducing manual tasks and enhancing the overall home loan journey for customers and team members.

First-time home buyer support

With a flexible and highly configurable system, alongside dedicated support, the bank simplified the process for first-time buyers. Participation in the Federal Government’s Home Guarantee Scheme and collaboration with broker networks further enhanced the bank’s support for this segment.

Through close collaboration between Sandstone Technology and Great Southern Bank the process involved;

- Needs assessment: Understanding the specific challenges and goals of Great Southern Bank to identify the pain points and align Sandstone’s solution with the bank’s overarching purpose of helping all Australians to own their own home.

- Configuration capability: Tailoring Sandstone’s Loan Origination platform to meet the bank's unique needs, removing friction from processes by utilising configurable management capabilities to provide a competitive advantage in the market.

- Deployment: Mapping out a deployment phase focused on ensuring a seamless integration to achieve smooth enhancements whilst maintaining operational continuity, with minimal disruption.

- Training: Providing comprehensive training within the bank to ensure smooth adoption of new features and empowered teams, able to utilise the system to its full potential, enhancing productivity and customer service.

Our impact

+

Increased Net Promoter Scores (NPS)

%

of applications approved in less than two days

Download the full Great Southern Bank Case Study