- Home

- Case Studies

- Bendigo & Adelaide Bank

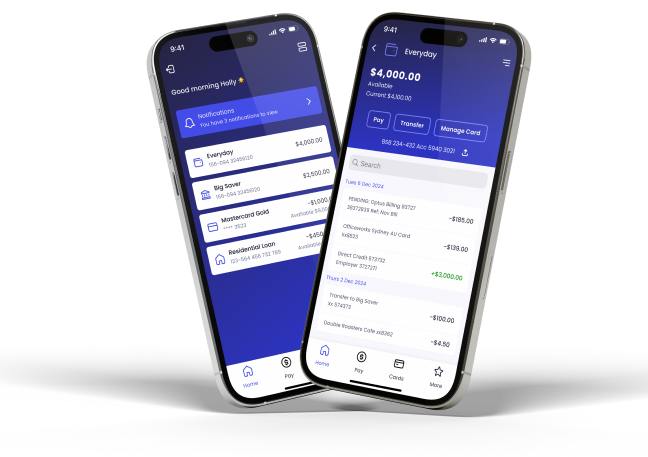

Bendigo and Adelaide Bank enhances its lending ecosystem.

Adelaide Bank was established in 1994, originating from the Co-operative Building Society of South Australia (the nation’s largest building society of the time).

In 2007, Adelaide Bank merged with Bendigo Bank to form Bendigo and Adelaide Bank Limited, a publicly listed and top 100 ASX company with more than 110,000 shareholders.

Our challenge: Transforming loan processing systems

Bendigo and Adelaide Bank partnered with Sandstone Technology to transform and streamline their loan processing systems and processes.

With legacy lending systems and a growing broker channel, Bendigo and Adelaide Bank’s Third-Party Banking Division identified the need to transform and remediate its loan processing systems. The bank needed to find a solution which would support the growth of its lending business, better serve its mortgage origination partners, and improve the customer experience.

Our solution

Streamlining Loan Processes with Automation

Wanting to eradicate manual loan processing tasks for both the Bank and its brokers, Bendigo and Adelaide Bank worked with Sandstone to identify where processes could be automated as much as possible. This included implementing eligibility rules and lending criteria filters within Sandstone’s LendFast platform which drove efficiencies in processing times.

Enhancing Broker Experience

Bendigo and Adelaide Bank together with Sandstone sought a way to further simplify the broker experience to allow a more automated capability to submit loan increases and product conversions in addition to new business.

Simultaneously, brokers receive more value-adding information from the Bank via enhanced back-channel messages in real-time at the point of submission. The result is fewer touchpoints, a significant reduction in rework, and an improved experience for brokers, which aligns to some of the critical success factors within the current transformation program.

Our impact

%

increased applications

%

improved efficiency

%

reduced manual reviews

Download the full Bendigo and Adelaide Bank Case Study