- Home

- Case Studies

- Arbuthnot Latham

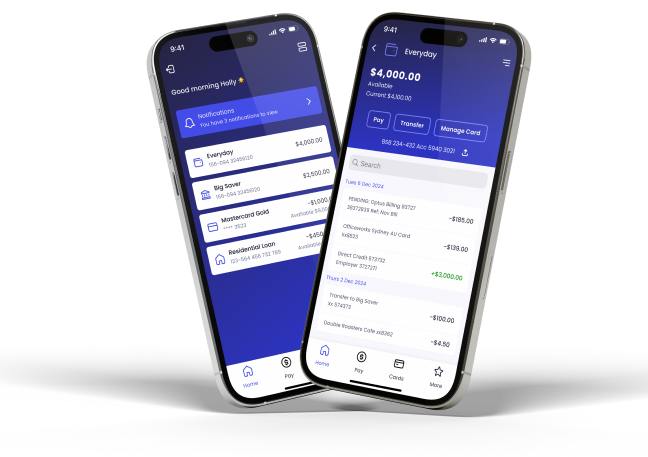

Arbuthnot Latham transforms their digital business.

Arbuthnot Latham’s high-net worth private clients want a personalised private banking experience coupled with the latest technological innovations, allowing them to access their accounts and transact when they want and via any channel of choice.

Given the complexity of Arbuthnot Latham’s client base, they were looking to work with Sandstone to deliver an innovative and flexible solution that would meet the needs of all of their clients via the one system.

The challenge: Deliver a mobile app

- To deliver an innovative and flexible solution that would meet the needs of all of their clients via the one system.

- To deliver a full Business Banking functionality including comprehensive entity management, many-to-sign, delegated user authority, payment authorisations, payroll management and complex bulk and batch payments.

- To provide International payments and FX and card management

Our solution

BankFast and Mobile App

Arbuthnot Latham and Sandstone Technology enjoyed a close working relationship and worked collaboratively to deliver the digital solution. The deployment ran extremely smoothly, delivered on time and under budget.

Key functionality

- Multi-channel feature rich personal, private and business banking functionality

- Sophisticated functionality for personal accounts including advanced search and account alerts

- Full Business Banking functionality including comprehensive entity management, many-to-sign, delegated user authority, payment authorisations, payroll management and complex bulk and batch payments.

- International payments and FX

- Card management

Our impact

mos.

Rapid, smooth and friction-free deployment

%+

true active mobile banking users

£ +

Average transaction value

Download the full Arbuthnot Latham Case Study