- Home

- Case Studies

- Abal Banking

Redefining Customer Relationships

How shared values helped deliver the ideal

Digital Banking solution for abal banking

Customer first approach

abal banking, known for its strong focus on building deep, meaningful relationships with both its retail and commercial customers, was seeking a digital banking partner who shared their customer-first philosophy. "As a relationship bank, we prioritise the connections we cultivate with our customers, and our needs differ from other small banks," says General Manager Banking, Emile Chahine.

When it was time to upgrade their digital banking platform, they wanted a partner who understood this approach. Sandstone Technology, with its shared values and innovative digital banking platform, proved to be the perfect fit, aligning seamlessly with abal banking’s vision of keeping customers at the forefront.

Our solution

Modern technology for a better customer experience

Facing the pressing need to stay competitive and meet evolving industry standards, abal banking recognised that their digital banking

platform required a critical upgrade. They needed to modernise the customer experience and introduce technology that aligned with their growth strategy.

“Without a new solution, we would limit our growth, impact customer retention, and pose possible security risks,” says Chief Operating Officer, Helen Michael. Time was also a critical factor. “Technology projects often run over budget and off schedule, but this had to be delivered on time and within budget,” added Michael, underscoring the urgency of the challenge.

A digital banking solution with a difference

Sandstone’s robust digital banking platform future-proofed the bank’s operations while placing customer experience at the heart of their digital transformation. With its robust functionality and advanced personalisation, the platform empowered the bank to streamline administrative tasks, allowing staff to focus on nurturing deeper customer relationships. By enhancing efficiency and delivering a more tailored banking experience to enable, abal banking to focus on prioritising what matters most—their customers.

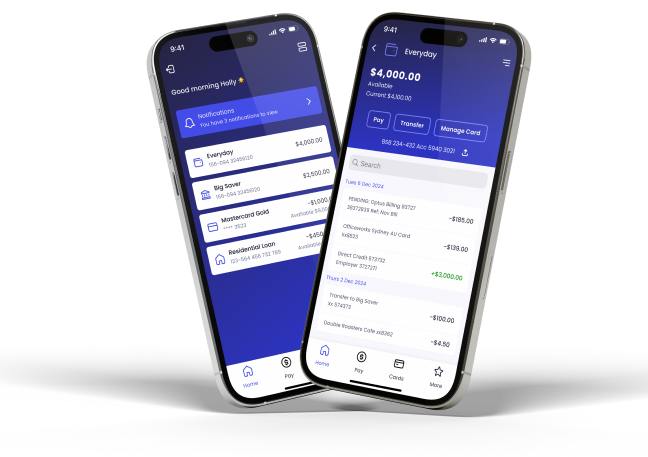

A mobile first approach

Highly Configurable Solution

Sandstone offered a high level of flexibility to configure features, styling, and other UI elements, ensuring the digital banking solutions were optimised to meet the bank’s specific needs. It enhanced process efficiency through management tools and provided tailored solutions.

Strategic partner of choice

By understanding the specific needs and challenges of the bank, Sandstone was able to align its solutions with the bank’s broader strategic goals. The bank sought a partner with extensive experience in the Australian market who could strike a balance between risk and innovation.

“We needed a technology partner who was willing to listen, open to discussion and would meet our requirements on time and on budget and Sandstone offered this to us.” says Michael.

Our Impact

Increased mobile app adoption

Within just six months, a significant number of users embraced the mobile app, with a number of desktop customers making the switch—showcasing the platform’s user friendly experience.

Enhanced customer experience

Right from launch, customers expressed their excitement, complementing the system for its fresh design, simplicity, and ease of navigation, reinforcing the bank’s customer first approach.

Boosted operational efficiency

Sandstone’s solutions empowered customers to be more self-sufficient, allowing the bank’s staff to focus on fostering deeper customer relationships rather than administrative tasks. This shift elevated both operational efficiency and relationship management.

Fast and seamless implementation

The integration was executed smoothly, with zero downtime, enabling the bank to go live and onboard customers without interruption. The project was completed on time, ensuring a seamless transition to the new system.

A thriving partnership for long-term sucess

The partnership between Sandstone and abal banking has evolved into a dynamic and collaborative relationship, driven by shared goals and a commitment to innovation. Together, both organisations have navigated industry challenges and market demands, developing tailored solutions that not only improve operational efficiency but also elevate the customer experience. This strategic alignment has helped abal banking stay competitive and adaptive in a rapidly changing financial environment.

Shared values driving mutual growth

At the core of this collaboration is a strong foundation of shared values. A focus on honesty, transparency, and open dialogue from both organisations has fostered a partnership built on trust. This approach has enabled both Sandstone and abal banking to grow in tandem, ensuring continued success for the future.

Download the full abal bank Case Study